AI in the fintech industry is being driven by investors, businesses, innovators, and regular users. Smart finance management technology saves money, makes money management easier, and helps both businesses and individuals earn more. If you want to break into this domain, this two-part blog series will discuss the market conditions and promising niches that are driving growth in the sector.

The AI Awakening

Artificial intelligence is not going out of style anytime soon. So, how did it come to change the banking sector, and what’s in store for the future?

Artificial Intelligence (AI) has emerged as the most significant wave of innovation, dominating modern technology over the last decade. We are already surrounded by AI applications in our daily lives, from phones, smart cars, and spam filters, to every device that recognizes voices.

“Hey, Alexa! Can you skip to Friday?”

Image 1 From voice assistants to map navigation, AI is changing how we perform daily tasks

Today, AI solutions support a range of business functions, from chatbots to planning and forecasting, so organizations can make better decisions and achieve better outcomes. Moreover, improvements in speech, natural language processing, and vision AI are revolutionizing business efficiency across the board. Given the demand and adoption, it’s no surprise that the AI industry is booming. Generating 433 billion USD market revenue in 2022, the AI industry will nearly double that and surpass half a trillion by 2023.

As AI continues to transform the business world, the banking industry is playing an increasingly prominent role in driving opportunities and use cases that support financial independence, increase accessibility and improve efficiency in banking services.

Finance Meets Tech

Figure 1 Fintech & AI Global Opportunity Snapshot

The traditional banking sector has experienced significant disruption over the last decade — particularly in payments, lending, wealth management, and retail banking. What’s interesting is that this change is not just affecting fintech start-ups. Instead, the biggest tech giants in the world, including Google, Amazon, Facebook, Apple, and Alibaba, are rushing in to use their enormous reach and technological prowess to compete fiercely with fintech start-ups.

Additionally, as business practices and consumer behavior changed following the pandemic, global digital transformation accelerated tenfold. We saw online sales becoming increasingly crucial in retailing. In 2022, e-commerce accounts for roughly 21% of global retail revenues, a significant increase from 13% in 2019.

From precise credit score tracking that processes loans instantly to less time spent on data entry, AI-based applications in fintech have transformed productivity, adding enormous value across all functions. The AI-powered fintech industry also represents an opportunity for traditional financial institutions to compete more effectively and remain relevant in today’s fast-paced world.

This blog will explore AI and ML in the context of fintech. However, before we dive right into AI applications in fintech, it is essential to understand the intricate fabric of the fintech realm.

Understanding Fintech

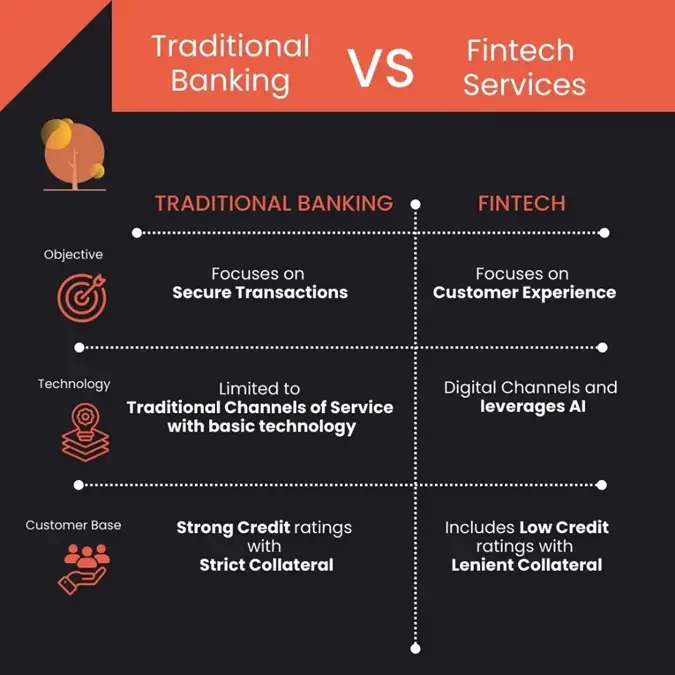

Figure 2 Comparison Between Traditional Financial Services and Fintech

A fintech service provider is a conduit for financial institutions and their customers. Fintech helps clients identify current and future needs and choose the best strategies and tools to keep their businesses current and viable in a dynamically changing environment. With AI, clients can simplify their financial operations by automating the delivery of financial services to consumers such as corporate houses, businesses, and even individuals through smartphone applications or websites.

The ‘Tech’ part of fintech is concerned with developing software and algorithms to provide efficient and innovative solutions. Compared to the traditional business models in banking and financial services, the fintech model offers real-time analysis and insights, which will help clients move from manual accounting to getting recommendations in real-time.